Almost daily, we see stories in the media about how rents are exorbitantly high in the capital and all you can get is a dilapidated, cold and mould infested property that is falling apart. Yes, there are properties in Wellington that are like that, but how tough is it out there at the moment for people looking for a new rental?

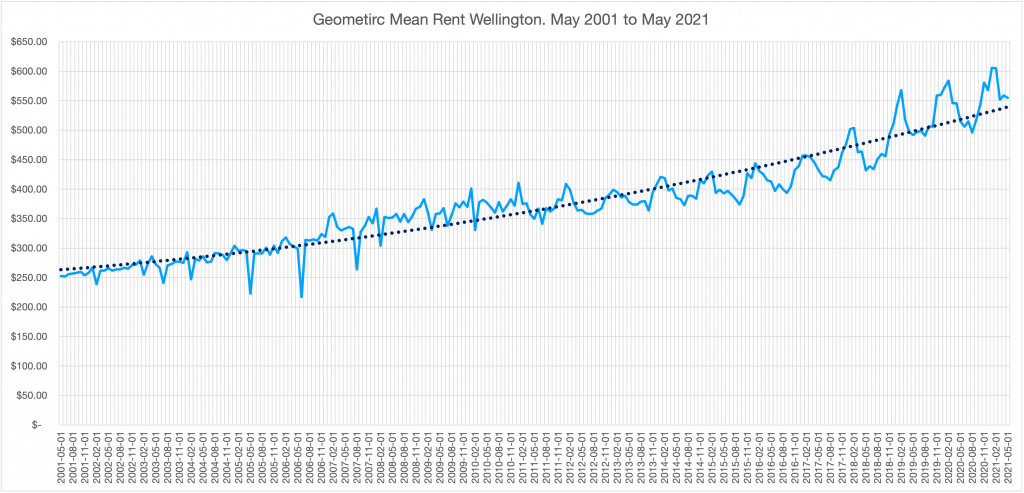

It very much depends on what type of property you are looking for. Wellington has traditionally always been much shorter on stock compared to Christchurch a closest comparable city. If you look at Trade Me and compare the two cities, Christchurch will typically have nearly double the available stock when compared to Wellington. This has led to a considerable price variance between the two cities. Wellington rents are nearly 40% more expensive than Christchurch. For May 2021, the geometric mean rent for Wellington was $555 per week whilst Christchurch was only $399 per week.

But things are starting to change in the capital. For the first time since we started tracking the number of available properties, Wellington now has more one-bedroom units than Christchurch. The number of two bedroom properties is also increasing. Two-thirds of available stock in Wellington is now either one or two bedroom properties. We are seeing a number of new apartments hitting the market at exactly the same time and these are typically one- to two-bedroom apartments. For the first time in a long time, people who are looking at this rental market are spoiled for choice, giving them the opportunity to negotiate on price. This is where marketing of our properties is so important. When the market is really tight and there is a shortage of stock, it is easy to find a tenant. However, when you are competing within the same pool of potential tenants, you have to ensure that your property is presented to the market professionally and to the highest quality. You also have to be realistic about price. There is no point in pricing your apartment above market value and having it empty for six weeks.

However, three-bedroom properties are still the most sought after. When these properties become available, they generally get the most enquiry. Only a quarter of properties that are available to rent are three-bedroom properties, though over one third of bonds lodged are for three-bedroom properties.

Winter is traditionally a quieter period for the rental sector. You would probably have heard that in summer rents exceeded $600 per week and Wellington had become the most expensive rental market in the country. What the headlines did not tell you is that this is heavily influenced by the student market. Bigger properties will make up the bulk of the properties that rent during the months of January and February leading to an artificially high rental market. Then, once the student season ends, rents reduce by as much as $50 a week.

What else is happening within the rental market?

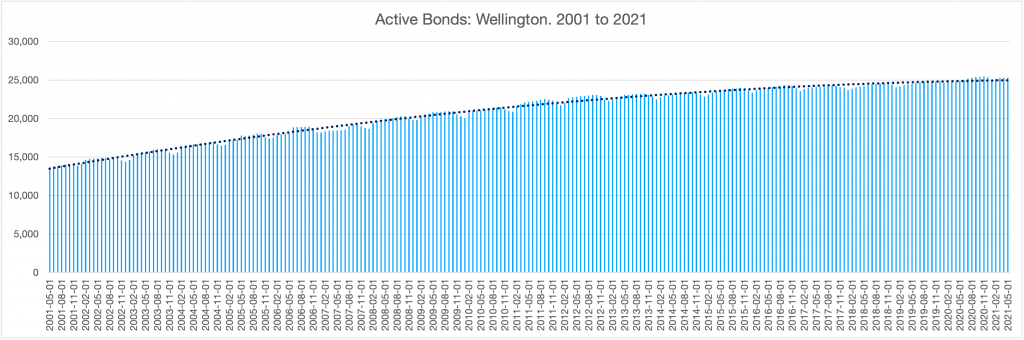

The other item to monitor is how many bonds are being lodged per month and data from Tenancy Services indicates that there is a spike in the tenant movement in summer months followed by a considerable drop for the rest of the year. Over a four year period, the number of bonds that have been lodged with tenancy services has dropped by just over 10%. However, the number of active bonds held for Wellington by Tenancy Services for the same period has increased by about 5%. This highlights that tenants are staying longer.

Not so long ago, the average length of a tenancy was approximately 18 months where now, it is likely to exceed two and half years.

By analysing this data, Tommy’s Property Management are in a far better position to give you the advice you need to hear rather than receiving the advice you want to hear. If you want to discuss what is happening in your suburb, make sure you contact us.

Our team are experts at what they do and have a thorough understanding of what is happening in the market.

Cheers,

Harrison Vaughan

Director